Credit Repair That Empowers You For Life

Our community helps you transform your credit, unlock opportunities and achieve financial growth.

We want to see you succeed for life and we will assist you in accomplishing the thing you truly desire!

We want to see you succeed for life and we will assist you in accomplishing the thing you truly desire!

Credit Repair That Empowers You For Life

Our community helps you transform your credit, unlock opportunities and achieve financial growth.

Welcome to the Seed Capital Financial Community

At Seed Capital Financial, we believe your credit score should open doors, not limit you. That's why we created a community to help you repair and build your credit in a supportive environment focused on TRUE empowerment.

Unlock your credit potential with Seed Capital's DIY credit repair model. No advisors, just a step-by-step process empowering you to take control:

Dive into ongoing financial education and coaching.

Utilize custom credit repair solutions tailored to your needs.

Affordable monitoring and identity theft protection

Access affordable monitoring and identity theft protection.

Join a supportive community group for encouragement and motivation.

At Seed Capital, we're here to guide you on a comprehensive journey towards credit mastery, financial confidence, and community empowerment. Your path to financial freedom starts now.

Start Your DIY Credit Repair Process Today

THE LAW IS ON YOUR SIDE

Skip the expensive credit repair companies & save your hard-earned money.

Choose the items that you want to dispute with a simple click of your mouse.

We’ve partnered with an array of credit building and financial products to meet any of your financial needs.

Join The Seed Capital Financial Community

We believe empowerment is a collaborative process. Our community will support, guide and celebrate you every step as you gain credit knowledge, implement solutions and achieve milestones in your journey.

You'll get:

Motivation from fellow members

Ongoing education

Expert coaching

Custom repair solutions

Identify theft protection

We treat you with dignity, equip you with knowledge, and provide flexible solutions that work for your budget. The Seed Capital Financial community empowers you to grow, achieve your financial goals, and change your life.

HOW IT WORKS

Yes, you got this! No more wasting your valuable time trying to decipher your credit reports or keep track of your reports and letters. We can manage it all for you and it’s free! Just purchase your credit reports through our partner credit monitoring provider!

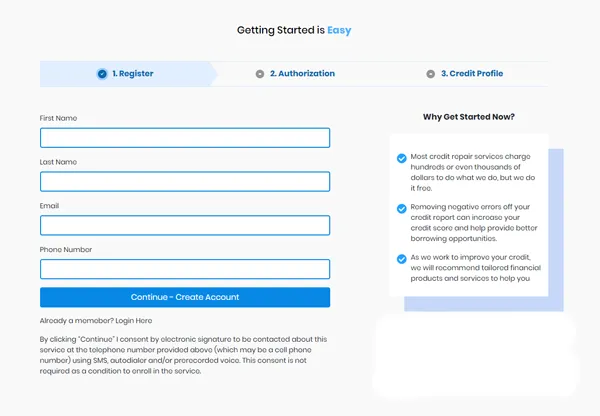

STEP 1

GET STARTED

It’s easy, and only takes a few minutes. First, click the get started button, register, and authorize us to show you all your info. With our fully online enrollment process, there are no pesky sales calls!

STEP 2

Credit Report

Then, follow the simple instructions to get a copy of your credit report and connect it so you can access and analyze it.

STEP 2

Credit Report

Then, follow the simple instructions to get a copy of your credit report and connect it so you can access and analyze it.

STEP 3

SELECT ITEMS & SEND LETTERS

After you have received your credit report, choose the items you see are inaccurate, then download and send your letters to the credit bureaus.

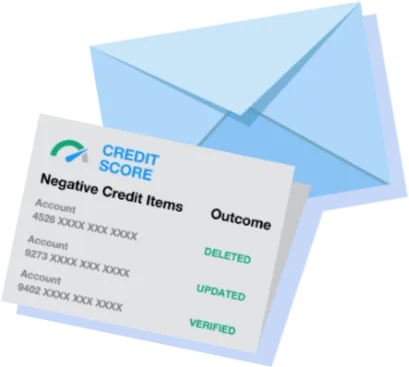

STEP 4

SIT BACK & RELAX

When the credit bureaus receive your sent letters, they will conduct an investigation of the items you challenged.

STEP 4

SIT BACK & RELAX

When the credit bureaus receive your sent letters, they will conduct an investigation of the items you challenged.

STEP 5

RESULTS

Your results should arrive within 30 days or so. If your credit report still has errors, log back in and review your reports to see the next steps to getting the inaccuracies corrected.

STEP 6

REPEAT

If the errors are still on your credit report, you can apply more pressure with advanced disputing methods.

STEP 6

REPEAT

If the errors are still on your credit report, you can apply more pressure with advanced disputing methods.

Step 7

Build & Optimize Credit

Along the way, you’ll be offered credit building products (loans, credit cards, etc) that may meet your financial goals and expand your credit profile.

What are you waiting for?

The only thing you have to lose is bad credit!

Frequently Asked Questions

How does this service work?

When you sign up for our service, you must choose the items appearing on your credit report you feel are incorrect, unfair, or questionable. You then can contact your creditors to demand their removal or correction. If the creditors do not fix the mistakes, you can up the pressure and give new information as to why this item should be removed from your reports. Additionally, we provide recommendations of products such as low interest credit cards, personal loans as well as auto and home loans.

How much does your service cost?

There is no cost for the platform and access to templates, this is a free service. This business model may seem bizarre because we do not charge anything for our service, but it is - we truly do not collect fees for our DIY credit repair service. Everyone should monitor his or her credit and in order to help you, we offer you the ability to keep an active credit monitoring account with our credit report partner MyScoreNow.com (Credit monitoring does have a cost to it and we cannot prevent them from collecting their fees and we do receive a referral fee). The purpose of the monitoring account is twofold. One, we need access to your credit in order to receive the credit information so you can begin working on your credit. And, two, it will allow them to monitor and inform you of any changes in your report as needed. The cost for credit monitoring is a small fraction of what you would pay a traditional credit repair company and it provides you with valuable insight and tools to keep an eye on your credit and improve it. While you are free to purchase a different 3rd party credit monitoring service, our platform has only been programmed to have the capability to automatically upload the details of credit reports and monitoring information via MyScoreNow.com.

How long does it take?

Many customers receive results within 45 days. The overall process can take six months to a year or longer depending on many different factors.

Why is this better than hiring a credit repair company?

Because it’s FREE! Even if you purchase the outside credit monitoring service to take full advantage of our free platform, you're saving much more than if you hired a third party credit repair company.

What type of items can you delete?

We do not delete anything from your credit reports. No one can predict that ANY item will be removed from your credit report and we don’t make any promises that you are able to get anything removed from your report. We can only give you the tools to best remove the items that are inaccurate, outdated or unverifiable. It is up to you to submit the forms you can prepare from our platform to your creditors and credit bureaus, they will determine whether matters need to be corrected or removed.

Do you guarantee I get approved for a home or auto loan?

Nope. Let us be clear, we do not guarantee any specific score improvement, and we definitely cannot promise you will be approved for financing of any kind. No one can. However by sending your dispute letters to the creditors and credit bureaus yourself, you may be able to remove errors and by removing those errors, it generally can have a positive impact on your credit score; but lenders take more than just your credit into consideration such as income, employment and other factors. By correcting inaccurate items in your credit report, you will likely have a better chance at securing favorable terms.

What is a credit report?

A credit report is a track record of both your personal and financial credit information. Which includes information taken from public records, personal identification and debt information.

What are the three credit bureaus?

A credit bureau - sometimes called a "consumer reporting agency" - is a business that collects relevant consumer information from creditors and courthouses, and then sells that information to interested parties such as potential lenders. Such information is sold in the form of a credit report. In the U.S., the three major credit bureaus are TransUnion, Experian, and Equifax.

Who can see my credit reports?

If you are in the process of trying to get financing on a home, automobile, credit card, charge card or personal loan, any creditor who you are working with has the ability to pull your credit report, but only with your permission. This is called an inquiry. Employers may also review your credit file if you are applying for a job, especially if security clearance is a requirement.

What is the Fair Credit Reporting Act and why was it created?

The Fair Credit Reporting Act (FCRA) was written in 1970 as an amendment to the Consumer Credit Protection Act. The FCRA provides additional measures of consumer protection in the areas of fairness, accuracy, and privacy of the information collected by the credit bureaus. It also allows you to personally engage in credit repair and maintenance processes, verifying that the information in your credit report is correct.